Dental veneers can transform your smile. They fix discoloration, chips, and even misalignment. But this cosmetic solution comes at a cost. Many people wonder if their insurance will help pay for it. The big question is: does dental insurance cover veneers?

At Utah Dental Center, we help patients in St. George understand their dental care options. We are committed to providing quality, affordable dentistry. In this post, we’ll explain how dental insurance applies to veneers. This will help you make an informed decision about your smile.

Understanding Dental Veneers

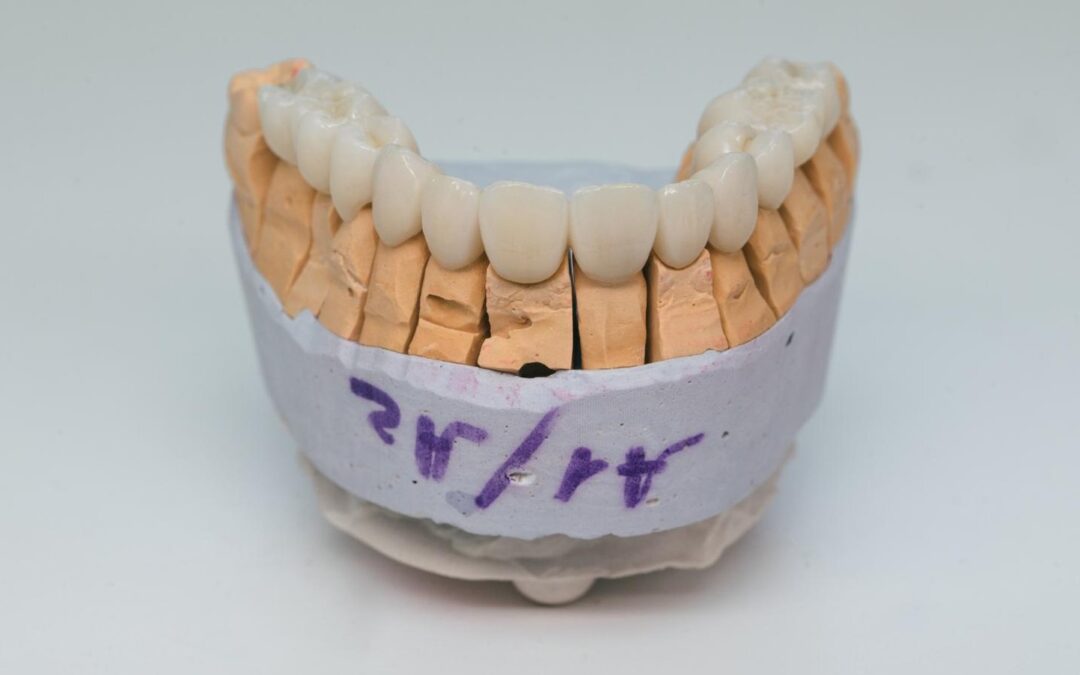

Dental veneers are thin, custom-made shells. They are designed to cover the front surface of your teeth. Veneers improve your appearance by changing the color, shape, size, or length of your teeth. They offer a way to get the smile of your dreams.

What are veneers made of?

Veneers are typically made from two types of materials: porcelain and composite resin.

- Porcelain veneers are strong and long-lasting. They resist stains well and look very natural. The process for porcelain veneers usually takes at least two visits.

- Composite veneers are made from a tooth-colored resin. They are usually applied in a single visit. Composite veneers are less expensive than porcelain. However, they may not last as long and can stain more easily.

People often get veneers for cosmetic reasons. This includes fixing teeth that are stained, chipped, crooked, or have gaps between them.

The Role of Dental Insurance

Dental insurance helps lower the cost of dental care. Most plans cover a portion of your treatments. In return, you pay a monthly premium. However, not all procedures are covered equally.

How dental insurance works

Most dental insurance plans focus on preventive care. They want to help you avoid major dental problems. Plans usually categorize treatments into three groups:

- Preventive Care: This includes regular check-ups, cleanings, and X-rays. Most plans cover these at a high percentage, often 100%.

- Basic Procedures: This covers simple treatments like fillings, extractions, and deep cleanings. Insurance typically covers a large portion of these costs.

- Major Procedures: This includes more complex treatments like crowns, bridges, and dentures. Your insurance will likely cover a smaller percentage of these procedures.

Does Dental Insurance Cover Veneers?

Now for the main question. Usually, dental insurance does not cover veneers. This is because veneers are almost always considered a cosmetic procedure. Insurance companies see them as a choice, not a medical necessity.

Insurance providers are more likely to cover treatments that restore tooth function. Since veneers are mainly for improving appearance, they are often excluded from coverage.

Are there exceptions?

In some rare cases, insurance might cover part of the cost of a veneer. This could happen if the veneer is needed for a medical reason. For example, if a tooth is damaged from an injury, a veneer might be considered restorative. In this case, it helps rebuild the tooth’s structure. These situations are uncommon. You will need to provide strong medical justification to your insurance provider.

Always contact your insurance provider directly for the most accurate information.

Factors Affecting Coverage Decisions

Several factors influence whether your insurance will cover veneers. It is important to understand your specific plan.

Key policy details

- Deductible: This is the amount you must pay out-of-pocket before your insurance starts to pay.

- Co-insurance: This is the percentage of costs you share with your insurance company after your deductible is met.

- Annual Maximum: This is the most your insurance plan will pay for your dental care in a plan year.

Medical necessity vs. cosmetic purpose

The biggest factor is whether the procedure is medically necessary or purely cosmetic. Insurance companies will require clear proof that a veneer is needed to restore a tooth’s function or health. Without this proof, they will classify it as cosmetic and deny coverage.

Pre-authorization

For any major procedure, it is wise to get pre-authorization from your insurance company. This means your dentist submits a treatment plan before the procedure. The insurance company reviews it and tells you what they will cover. This helps you avoid unexpected costs.

Alternatives and Options

If your insurance doesn’t cover veneers, you still have options to achieve a better smile.

Alternative treatments that may be covered

- Crowns: A dental crown covers the entire tooth. If a tooth is badly decayed or broken, insurance is more likely to cover a crown because it restores function.

- Bonding: Dental bonding uses composite resin to repair chips, gaps, or discoloration. It is less expensive than veneers and is sometimes covered by insurance, especially if it’s for restorative purposes.

Financing options for veneers

Even without insurance coverage, you can still afford veneers. Many dental offices offer financing options to make the treatment more accessible.

- Payment Plans: At Utah Dental Center, we offer flexible financing. This allows you to spread the cost of your treatment over several months.

- Dental Loans: Some financial institutions offer loans specifically for medical and dental procedures.

Get Your Personalized Plan Today

While dental insurance typically does not cover veneers, you have other ways to get the smile you want. Understanding your insurance policy and exploring financing options are great first steps. Alternative treatments like crowns or bonding might also be suitable and have better insurance coverage.

As a trusted St. George dentist, we are here to help you navigate your options. At Utah Dental Center, we provide personalized care to meet your unique needs. We can create a treatment plan that works for your goals and your budget.

Contact Utah Dental Center today to schedule a consultation. Let’s work together to build your healthy, beautiful smile.